This post was last updated on July 8th, 2024 at 04:41 pm.

This is the third of a four part series. See part 1, part 2, or part 4.

In part 1 and part 2 of this series, we looked at how our link between donations and the fund accounting system could be used to handle some regular donations. For this post and part 4, we’ll build on that foundation to give you an idea of how flexible this linking system can be and how it can track and process different types of gifts.

This post will look at how you could handle donations from a fund raising event.

The Situation

Let’s say our fictitious church is starting a fund raising campaign to remodel the church building and build an addition. We’ll use an accounting fund called Building Fund to track our finances for this project.

We’ll be getting regular donations for this event during services and so on, all of which we’ll handle like we did our other donations. These donations will be recorded in a donation fund called Building Campaign.

Here’s the new wrinkle: we’re having an event – a big presentation where we’ll be inviting members to come see how great our addition is going to be, what it will cost, and what our fund raising goals are. People will be able to donate for the project at the event.

Now we could just record these donations like we would any others for the Building Campaign. But what if we want to have more specific records? What if we want people’s donation statements to show their giving from the event? What if we want to reflect on how much was donated at the event, as opposed to the regular offerings?

Here’s one way we could record donations from the event in a manner that leaves us with more accounting insight.

Accounting Setup

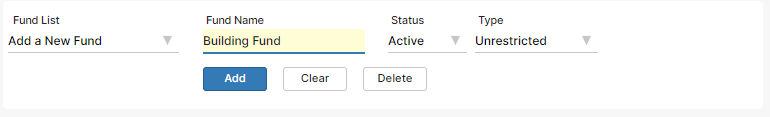

First we need our accounting fund – Building Fund. This is the one accounting fund we’ll use to designate all the money for our building upgrades. We’ll create it in General Ledger: Accounting Funds.

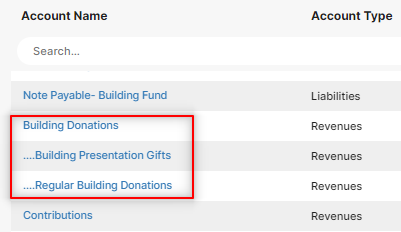

We can set up the revenue accounts to separate the regular donations from the fund raiser. I decided to create a heading account for both types of donations with a sub-account for each.

These will be the line items on a Statement of Activities (which is like a Profit and Loss) to show the types of revenue coming into the Building Fund.

Donation Setup

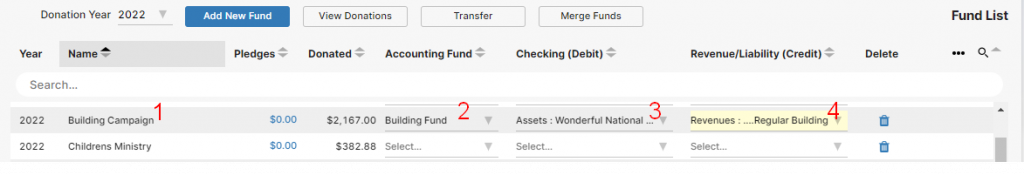

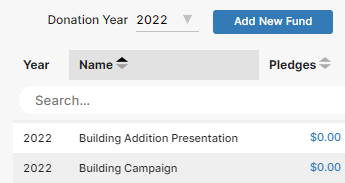

We’ll set up two donation funds to record the two types of donations (Donations: Funds & Donations). These are what will show up on givers’ donation statements.

We can set up the accounting link for each fund by using the three drop down boxes to the right of each fund. The columns are Checking (Debit), Revenue/Liability (Credit), and Accounting Fund.

We want to set up the Building Campaign donation fund (labeled 1)

so that donations are recorded in the Building Fund accounting fund (2)

as a debit to our regular checking account (3)

and a credit to our Regular Building Donations revenue account (4).

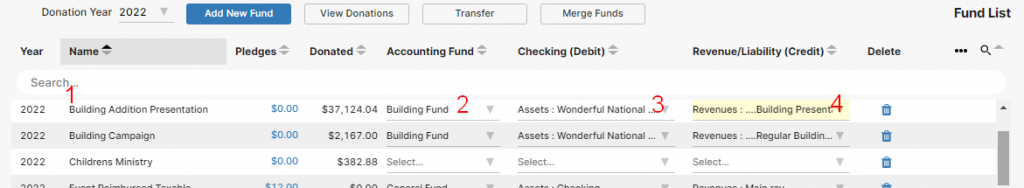

For our gifts from our big presentation, we’ll set up the Building Addition Presentation donation fund (1)

to record donations in the same Building Fund accounting fund (2)

and the same checking account (3)

but with our other revenue account – Building Presentation Gifts (4).

Entering the Gifts

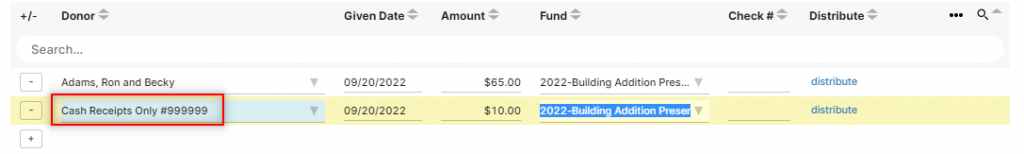

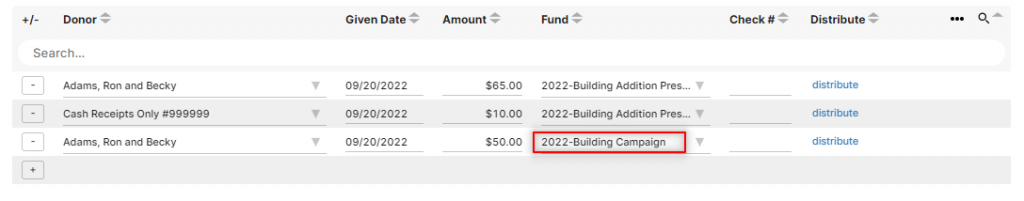

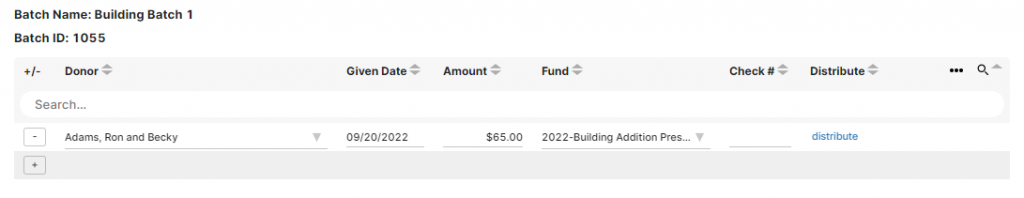

We’ll create a special donation batch for our big presentation. If the Adams family were to donate $65 at this event, we would record it as shown, taking care to use the correct donation fund.

Any money donated anonymously can be saved in the 999999 donor number – IconCMO’s default donor number for loose plate offerings.

Regular weekly donations for the Building Campaign can be entered along with your other donations. For simplicity, I’m creating a batch with just a $50 donation from the Adams family.

The Result

Let’s look at the resulting reports. (Other line items on these reports are from parts 1 and 2 of this blog post series.)

If we create a donation statement for the Adams household, we can see their giving at the presentation separate from their regular giving to the building project.

On the accounting side, we have separate line items for the gifts we received through the presentation and the regular weekly gifts we received for the building project.

Note that if we wanted to show just the revenues and expenditures recorded for the Building Fund accounting fund, we could run this report for just the Building Fund instead of all funds combined.

Next Time

What if you’re taking donations on behalf of another organization? That is, what if your church is acting as the “middle man”, passing donations from your members on to some worthy cause? How should you record these donations? That will be the topic of our fourth and final post in this series.

Photo by Possessed Photography on Unsplash

[…] is part 2 of a four part series. See part 1, part 3, or part […]