This post was last updated on October 6th, 2022 at 03:12 pm.

A church budget is important to most church organizations and is a highly-utilized feature in IconCMO. However, budgets can only be set for revenue and expense accounts, which can pose a problem if you want to budget for a liability account such as a mortgage.

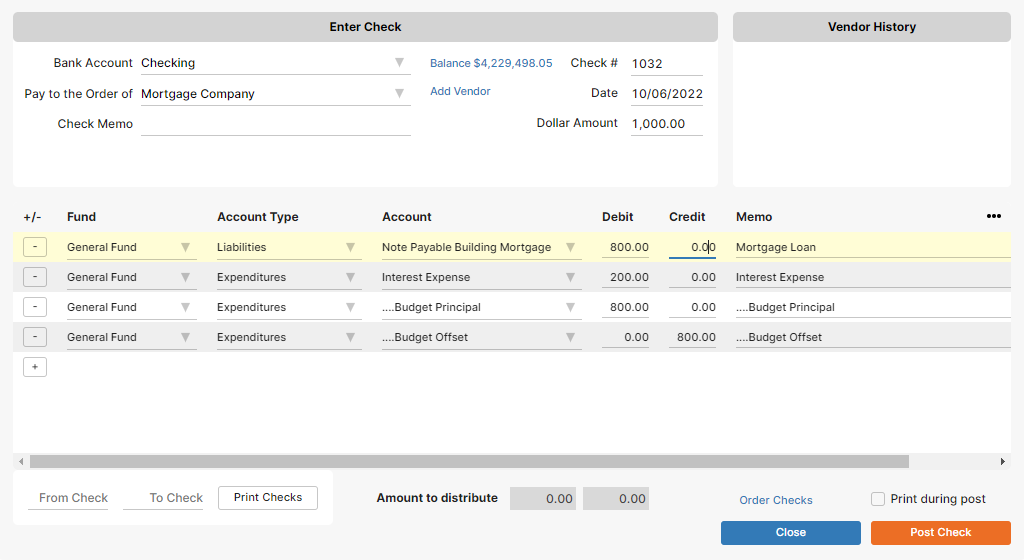

For example, a typical Mortgage Payment of $1,000 looks like this:

- Credit Checkbook (Asset) = 1000.00

- Debit Mortgage Loan (Liability) = 800.00

- Debit Interest (Expense) = 200.00

The entries are in balance and you are able to post the check or journal entry. However, in this scenario you are only able to budget for the $200 interest expense since $800.00 of the payment goes towards your mortgage liability account.

Solution – Setup to For a Church Mortgage in the Church Budget

Go to your Chart of Accounts and create an expense account called Budget Principle, then Create a sub-account underneath it called Budget Offset. Add the corresponding entries when you make a check or create a journal entry to record a mortgage payment.

- Credit Checkbook (Asset) = 1000.00

- Debit Mortgage Loan (Liability) = 800.00

- Debit Interest (Expense) = 200.00

- Credit Budget Offset (Expense) = 800.00

- Debit Budget Principle (Expense) = 800.00

With the two additional entries, you can now budget for your mortgage principle. Budget Offset is a sub-account of Principle Expense, so it will not show on the Statement of Activities report since they offset each other.

I hope you found this helpful. If there’s any other accounting scenarios you’d like to see in future posts, please comment below! 🙂

Photo Credit: pixelmattic via Compfight cc

How would you recommend a payment for principal only, when it comes from a restricted account. We have a restricted account for mortgage prepayments and it increases when a member donates to that account and decreases when we pay it towards the mortgage. Today there is no connection to the mortgage liability to reduce that amount. Would you do a journal entry to reduce the liability and increase what? Thank you!

Hello John.

A regular loan payment that would include interest would be a debit to the loan payable and the interest expense, and a credit to the cash (or asset account checking). When you are doing a principal only payment you would just remove the interest piece from this process. So it would be a debit to the loan payable and credit to the cash.

I was looking for a way to budget our total church mortgage payment and found a very nice solution on your website. Great job!!!!

I have another question for you. We are refinancing our mortgage. The entries I think are quite simple, debit the old mortgage, credit the new mortgage Liability accounts. No new money is involved. The only problem is the new refinanced mortgage is a little different than the old mortgage due to the fact the principal monthly payments were posted were not exactly the same as the banks records. Most likely the amortization schedule was not used correctly.

Example:

3,000,000 old mortgage

2,995,000 new mortgage

5,000

What do I do with the 5,000?

I would really appreciate it if you would email me back.

Thanks and God bless,

John Saglimbeni

PS – I sent you the same message to support@iconcmo.com. I did that first before I looked in this area. Please accept my apology for sending 2 emails. Thanks

Hello John,

I believe you should have received an email from Connie about this question. It would be best to use the email chain to answer this type of question because more than likely we will need to solicit more information about it. Thank you for reading our blog and hope it helped in other areas for your organization. We create a lot of accounting content for churches so please feel free to pass the blog on to others that might need help. Thank you.

Jay

I do not get the budge offset account either. My objective in including the principal payment in the budger was to insure that we were asking in general fund offerings the funds needed to make this pa payment.

My idea would be to have the budget principal offset an equity account.k

Verne in IconCMO we utilize FASB guidelines double entry fund accounting. We do not allow you to hit the net assets directly. In the example the actual expense is zero because the Budget Account and Offset net to zero. This is just a way to show record in the budget report as the principle amount is lowering a liability.

Thanks,

Perhaps it would be helpful to explain how the budget should be set up. Does only the “Budget Principal” expense get “budgeted’ and the “Budget Offset” expense does not? If only one gets budgeted, what is the effect on the Budget Variance report? It seems to me the overall expense variances total would be misleading. If both are budgeted, then it seems they would cancel each other out in the overall budget totals.

Alice,

Thank you for your question. Since the mortgage is in the liabilities you only have an interest expense. The principal is not actually an expense. But since churches want to budget on it and it is a very common question a work-a-round is to create a “Principle Mortgage Expense” with a sub account of “Principle Mortgage Offset Expense”. Each month a Debit would be entered for the principle amount on the main expense account and the offset would be a credit amount for the exact same dollar value. Making the expense net of the two expense accounts always zero. When you do your budget you are only going to budget the Principle Mortgage Expense account and not the offset. This way you can see how much is going to the mortgage each month. Since the principal is predetermined for the year (if the church does not make additional principal payments) then the variance should always be zero.

Josh

I am trying to understand how the budget should be set up. I think I understand your explanation for how the actual expenses are recorded.

How will the principal / offset be reflected in the budget reports?

Alice,

You will need to show the sub-accounts. There are no actual expenses occurring. So a net of zero expenses must be reflected correctly no matter what we do and the should be reflected in the reports as such. For an example on a 1000 dollar budget per month for Budgeted Principle. The Budget comparison actual would list the Budget Principle 1000.00, Budget Offset(Actual) -1000.00, Sub-total net 0.00 expense. This is all correct. Since the mortgage is in the liabilities and is being reduced by the principle amount it helps to view the Statement of Financial Position to clarify the budget reports when reviewing the financials.

I see how that budget set up would work for the budget variance report. However when I want to prepare a top level budget for the board, I would want my overall totals to be reflective of what the income [cash] requirements are. The purpose [for me anyway] in budgeting expenses is to know what level of income is required.

Let’s say I am a small org and have a mortgage payment and a utility bill that I wish to present a budget for. The mortgage payment principal averages $800 per month and the interest will average $200 per month. In addition I have a utility bill that averages $150 per month.

If I were to set up the budget as I understand you have described it would be as follows:

Interest Expense: $200

Utility Expense: $150

Mortgage Principal Budget: $800

Mortgage Principal Offset: -$800

Total Monthly Budget: $350

Total Annual Budget: $4,200

What I would like to show is an income/cash requirement budget of $1150 per month [$13,800 annually]. The common complaint I encounter is “We made our budgeted income targets. Why are we out of money?” I am not sure how that situation is avoided by using the method you described. It seems like there might be some sort of ‘Other Expense’ that is treated like periodic depreciation or amortization that could be used to pull the outflowing cash to the bottom line… but then I’m not a trained accountant.

Or perhaps I’m missing the boat altogether on this. Thanks for trying to clarify for me.

Alice,

You are placing too much emphasis on the Budget report. It is not a complete reflection of the finances. There is not a single report that is going to offer you this. The finance council should review three separate reports and learn how to read these different reports to obtain an overall understanding of the churches net worth.

1) Budget Report – Meant to offer an estimate of expenses that will be incurred over the next year.

2) Statement of Activites – Designed to provide the positive/negative net worth of the church.

3) Statement of Financial Position – Designed to show how the net worth of a church is divided. Liquid/Fixed/Liabilities/ etc.

Why do you need all three? If a large building project is increasing the Fixed Assets and using all the liquid the first two reports will not help you at all. Yet the third report will not help you understand how the finances are trending. Without the budget you won’t have an estimate of your costs coming up. Failure to review at least these three reports will never give you a complete picture of the finances.

Thank you Josh

We do use all the reports.

I just would like to see the budget reports enhanced to better help us with planning for future expenses. I was hoping to find a way to apply your initial suggestion to the planning process.

FYI – I find the new Annual Budget Comparison report to be very helpful.