This post was last updated on November 22nd, 2021 at 10:14 am.

Is Quickbooks The Right Choice For Church Accounting?

When choosing a church accounting package, the first question that should be asked of any package is — does it obey the Financial Accounting Standard Boards (FASB) Topic 958 and other rules set forth by GAAP and the IRS? If the software doesn’t enforce strict guidelines to follow these rules, then it really doesn’t matter how easy it is to use. Not following the rules, regulations, and policies will eventually catch up to the organization, and they will pay the price via fines or losing tax exemption. Quickbooks for churches unfortunately doesn’t follow even the simplest and required rules for church.

In this post, we will go over general accounting principles and explain why church accounting is different than for-profit business accounting. Then, we are going to layout where Quickbooks fails the Topic 958 rules for churches. Then we’re going to show an example of what it should look like when a budget has funds and accounts working together.

Understanding General Accounting Principles

Chart of accounts general explanation

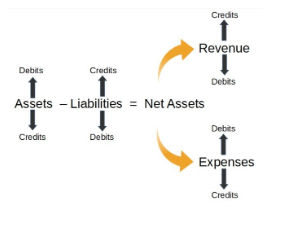

Any chart of accounts is made up of five primary areas which are:

- Assets

- Liabilities

- Equity

- Income

- Expenses

The asset, liability, and equity account types carry balances. These balances go up and down based on transactions entered. Additionally, those balances carry-over from one year to another. The income and expense account types start-over at the beginning of the accounting year. The income and expenses don’t carry balances. They only track how much money came in and how much money went out.

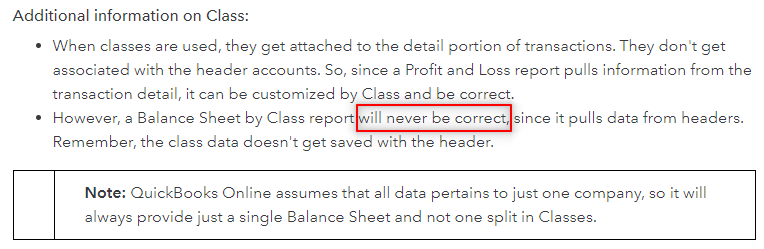

Why is understanding the primary areas of the chart of accounts important? Because this is one area where Quickbooks’ structure ignores accounting principles for churches. The chart of accounts for churches must also break down into funds. This fund break down in turn, provides reports by each fund that follows FASB guidelines. Quickbooks for churches fails in this aspect- as seen in Quickbook’s FAQ. Below is one snippet from their website illustrating why Quickbooks doesn’t follow what’s required via the FASB guidelines.

Why does Quickbooks work for business accounting? Simple. Businesses don’t need their chart of accounts broken into funds, unlike churches. Churches must have their reporting broken down because of donor imposed restrictions so they can show accountability to the purpose which the donation was collected for. In essence, church accounting is conceptually more difficult than for profit accounting in this regard.

Funds – What Are They?

A fund is money your church collects from donors for a specific purpose. The most common funds are General Fund, Mission Fund, Youth Fund, and Building Fund. If money is collected for the Youth Fund, then it must be used for Youth expenses. It can’t be used for the church’s electricity bill. That bill should be paid by the General Fund which takes care of the church’s operations.

What does this have to do with software? Accurate church accounting software will track the income and expenses as well as run balances on assets, liabilities, and equity accounts by fund. The software can break out on a report just the transactions (the accounts) that affect the Youth Fund. Quickbooks for churches can’t do this in the reporting. The FASB required reporting helps the church better understand how each area is doing and this is where Quickbooks fails the FASB Topic 958.

A quick fund example showing why Quickbooks can’t do fund accounting

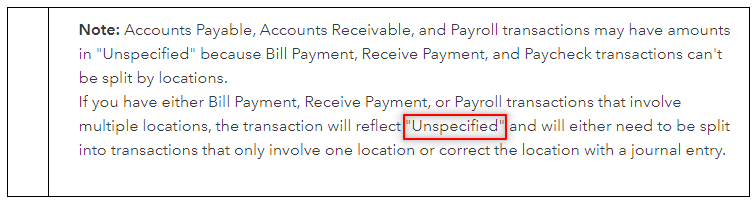

In simple terms, you have a loan for a remodel that falls under the General Fund and gets paid monthly from that fund. If you are using Quickbooks, it wouldn’t break out the fund’s liability accounts properly. You would see something that shows ‘Unspecified’ monies in the liabilities. Here’s another screenshot of Quickbooks FAQ’s.

However, in a true fund accounting system if you run a balance sheet report for the Youth Fund, this loan would NOT show up. Why? Because the loan is assigned to the General Fund only, instead of “unspecified.” Essentially, you’re able to run two different balance sheet reports, one for the Youth and one for the General Fund, and get different numbers for each.

Quickbooks For Churches Workarounds

Using business software like Quickbooks for churches can get messy, quickly. We listed some of the workarounds Quickbooks recommends for setting up churches.

- They advise setting up separate asset accounts for each fund — essentially a checking sub-account for each fund you have.

- Set up sub-accounts for each type of income and expenses that you need across your funds. So you may have a youth food expense and also a men’s ministry food expense.

- Setting up payroll liability sub-accounts if employees are paid out of different funds.

And even with these workarounds, Quickbooks can’t give you FASB compliant reports. In fact, their workarounds make your reports messier and more confusing.

Church Budgets by Fund

Let’s first discuss what a budget is. A budget is what we like to call a future projection report. You create a budget, typically before you actually spend the money. Unlike balance sheet reports and P&L’s that show what has already been done — i.e. historical numbers, budgets are trying to predict the future based on past accounting cycles.

What’s wrong with Quickbooks for church budgets?

Quickbooks lacks the ability to budget by fund. While they do allow numbers entered against revenue and expense accounts, they don’t allow numbers to get entered against a fund (or class as they call it) and an account. In other words, you would need at least a two-tier categorization for budgeting by the fund. The two levels would be the account and the fund itself. Because Quickbooks doesn’t have the ability to budget a line item by each fund.

Let’s look at how funds work with the church budget

A simple example of funds working with budgets is to have one income account that would ‘tag’ money coming into that income account with a fund. The church receives $50.00 for General fund donations and $10.00 for the Youth fund. The income account would be something like 4000-donations. That income account would further break down into the funds in the following manner. By tagging each transaction with a fund we are essentially creating different containers of money within the common revenue account called 4000-donations.

| Account | Fund (tagged) | Amount |

| 4000-donations | General Fund | $50.00 |

| 4000-donations | Youth Fund | $10.00 |

| Total (4000-donations) | $60.00 |

In the table above you can see that the organization can have one income account (4000-donations), but by using fund accounting, they can tag the transactions. By doing this, the numbers would show separately for the Youth fund and the General fund for any reporting, including budgets. A Youth fund report would only show the $10.00 for the 4000-donations income account. A General fund report would only show $50.00 for the 4000-donations income account. Even though the money came through the same income account!

A true fund-based accounting system can break these out not only in historical reporting such as a P&L, but for budgets as well. Budgets also need this two-level tier setup to work. Without entering numbers against both the fund and account, the church has no chance of creating a budget that makes any sense.

There are better options than Quickbooks for Churches!

Churches have other options to stay compliant with FASB. A true fund-based accounting system, like IconCMO, can keep the church on the straight and narrow. When you want to follow FASB rules and do things right, a great option is IconCMO. IconCMO solves all the Quickbooks issues discussed here and more. It has membership, donations, groups, communication, and other features that Quickbooks doesn’t.

Quickbooks For Churches Conclusion

As we discussed earlier, using Quickbooks is a poor choice for church accounting due to the inability to report information by fund. Budgeting also relies on fund separation for its reporting as well. To see how well the organization is doing in its missions, the budgets must be set up by each mission area (its fund). By setting budgets up this way, the church can answer hard questions like:

- is the mission working the best way possible?

- are there ways we can be more efficient but provide the same level of ministry service?

- are we receiving enough donations to keep the ministry going?

- and many more questions!

Contact Us for a 1-on-1 Guided Tour!

Thanks for scheduling a time with us!

Looking forward to talking with you,

Carrie at Icon Systems, Inc.

Our Finance Committee is just learning about ICON. Can we import past records/ reports from QuickBooks to Icon?

Thank you

Hello Terri,

Thank you for your interest in IconCMO. IconCMO allows the organization to start with beginning balances by fund and checkbook, as well as liabilities on a certain date (ie beginning of the year is one example). IconCMO was built from the ground up to use fund accounting as required by FASB, IRS and other entities that churches must follow. Unfortunately, Quickbooks was not built this way and relies on multiple works arounds like classes or projects to give the reports needs to non-profits. Because of these work-arounds the data becomes unusable to import. To read more on how the balance sheet (by fund) can become unbalanced in QB, please read this article. IconCMO was developed to require all transactions to stay in balance, thus each report follows the guidelines of FASB, GAAP, and IRS.

We can bring in membership. If you would like to set up a 1 on 1 webinar to see the system or ask questions, at no cost please go here and schedule a date and time. Thank you.