This post was last updated on February 19th, 2024 at 03:46 pm.

Tips on how you can make it easier for your organization to record transactions and accomplish the daily accounting work using a church fund accounting system like IconCMO.

Knowing the Fund & COA is essential for each transaction:

Now that we know the differences between funds and COA from part one. And have seen an example in part two using families. Then in part three applying them to church funds, we can move onto some tips using these fundamentals in this final part of our series.

Before moving onto to the tips (1 & 2), we need to understand how individual accounts in the COA relate to the “Budget Line” items that users are familiar with. COA and “Budget Line” items are equivalent as far as account descriptions. In fact in most systems the budget should come right from the chart of accounts. By rephrasing the terminology (COA => Budget Line), it helps the user determine which line on the church’s budget should be affected with the transaction.

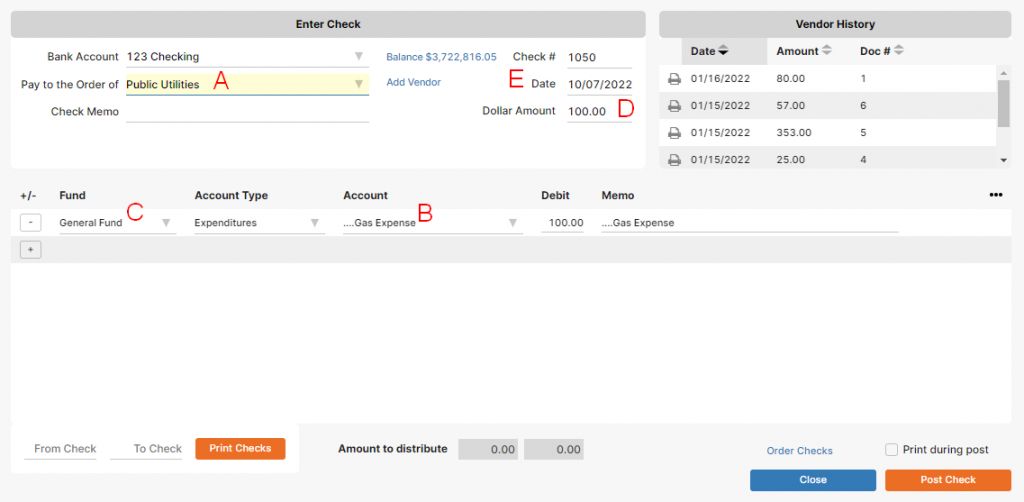

Additionally in the screen shots below, you will see a column ‘C’ called “Fund (Who Pays For It?)”. The “Fund (Who Pays For It?)” column is equivalent to the Fund, discussed previously. By appending the question “Who Pays For It?”, it helps the user make the conscience decision when inputting the transaction as to which financial statement it should appear on – General Fund, Youth Fund, Mission Fund, etc.

1. Handling Reoccurring Transactions Consistently For Church Fund Accounting

One useful tool is a simple spreadsheet (like the one to the above) with the details necessary for each reoccurring transaction. This will help to ensure consistency for data entry each month and save time looking up previous transactions when writing checks. A transaction is easily done using only a few columns. Think of it as a cheat sheet.

Additionally, a user can use the Excel document for non-reoccurring transactions, if you like. Using the trip and food example from part three, the last four entries are entered using the same format as the reoccurring transaction.

Let’s use a utility bill as an example. In most churches this bill would be paid by the General Fund (Who pays for it?). Would you want this showing up on the Youth Fund report? Essentially by choosing the Fund (Who pays for it?), the user is choosing which ministry report should show the expense.

How to apply the excel sheet above in IconCMO:

Below you will see circled letters that correspond to the lettered columns from the sample Excel sheet above. The two most important fields are the (B) and (C) columns which are the Budget Line (B) and Fund (Who pays For It?) (C). When you knows these, it’s simple to write a check and ensure your reports are right 100% of the time. All accounting transaction screens (AP, Checkbook Writing & Deposits, Credit Card Charges, General Journal Entries, etc) in IconCMO have a similar screen layout and are created using a Fund (C) and Budget Line item (B).

2. Purchasing Items and Entering Them Correctly, Every Time

Typically in any organization there are people tasked with purchasing items for the organization or for daily operations. For example, many times a pastor goes to lunch with someone to council them, or the secretary purchases some office supplies. How can you properly account for these items?

Properly accounting for purchased items involves more than telling the treasurer how much you spent at WalMart or a restaurant. The treasurer (or data entry person) needs to know the proper expense (Budget Line) to apply it to and which Fund (Who pays for it?) should pay for it. We often hear from churches that the purchaser or even the treasurer doesn’t know what it should be. If the purchaser doesn’t know this, then what business do they have buying things for the organization?

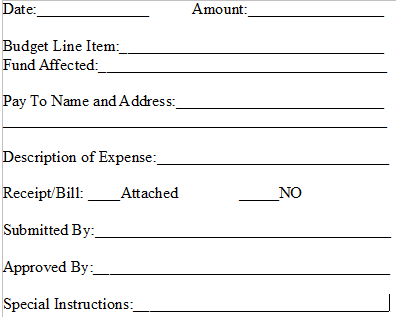

To resolve this issue, we recommend another tool that we have found helpful for churches. Submitting an expense sheet like the one above to the treasurer resolves a lot of issues. By using this simple tool, treasurers remove all issues with going back and editing transactions and cluttering their accounting system.

An example expense sheet for church fund accounting

*Important – We encourage church councils to implement a process that has the following goal in mind – to keep treasurers from editing numerous accounting transactions after the fact. So the purchaser needs to communicate the needed information for correct data entry and accountability. We suggested one method here, however feel free to brainstorm if this one doesn’t work for your organization, but keep this goal in mind.

A sample of an expense voucher for a church may look like the following. Feel free to adjust as needed for your church.

There are a few key pieces that are absolute musts to ensure complete and accurate accounting: the date, amount, budget line item, fund affected, and name of payee (Pay To). Depending on your church’s internal controls and bylaws, the other items like approval, submitted by, address, and special instructions may or may not be needed. With these two tools there should be very little confusion or errors on any compliant church accounting system like IconCMO and for the treasurer that inputs the transactions for the church.

If the input is incorrect in any fashion, the church council can’t expect correct reports from the treasurer.

We hope that this four part series has helped to light your path on how to properly account for all the church’s money and gives you some tools to help with that task.

Leave a Reply