This post was last updated on February 19th, 2024 at 04:09 pm.

Churches can show their gratitude to donors when church staffers do all they can to help donors report their donations to the IRS as tax deductions. This is typically in the form of the donation statement or donor receipt.

A Donation Statement Must Have!

The best way a church can help in this process is to give end-of-year donation statements to their donors that include a declaration like the following:

“No goods or services were provided by the church in return

for the donation.”Wording like this is essential for donors to report their donations, per the IRS.

(To learn what to do if donors do receive goods and services, or if donors make non-cash donations, see our free ebook – Recording and Increasing Church Donations.)

Including the Letter Steps

So how can IconCMO users include that important declaration for the IRS on donation statements? IconCMO makes it easy. Below are the steps to follow, along with some screenshots to follow the outlined steps.

1. Make sure you’re in the correct fiscal year for the statements (Organization > Preferences > Personal Preferences).

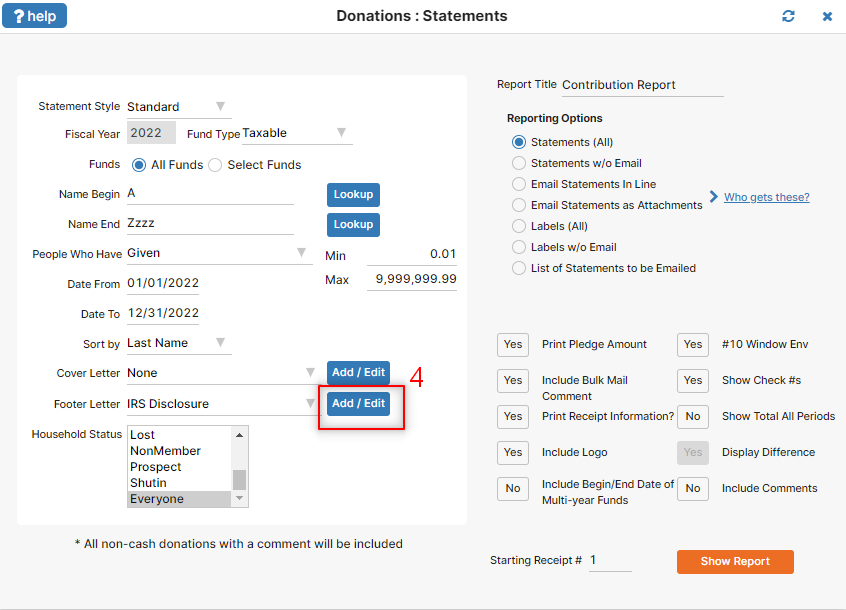

2. Go to Donations: Statements in the left side menu.

3. Go down through the various options to set up the format, fund type, funds, name range, date range, and so on.

4. Click ‘Lookup’ next to ‘Letter To Use’. This will bring up a new window.

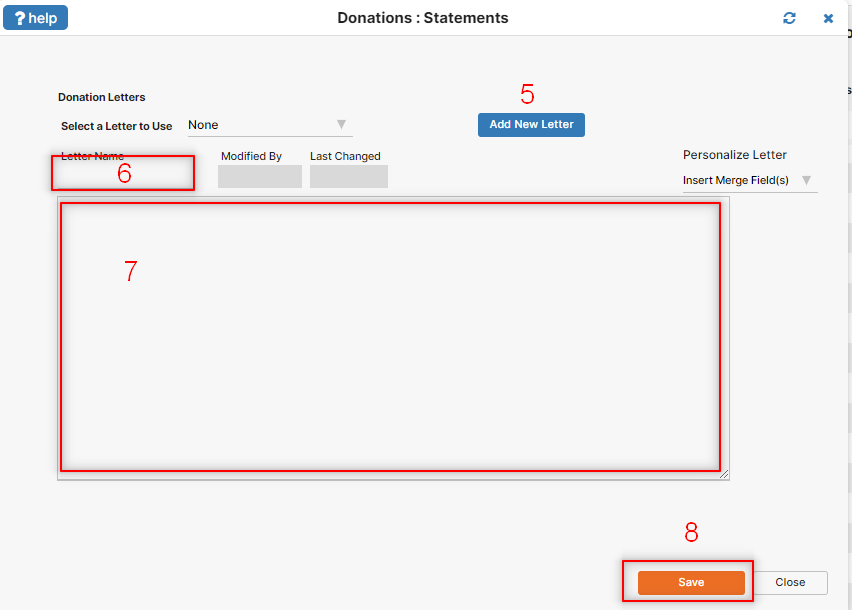

5. Then click the ‘Add New Letter’ button which clears the form for you to add in new letter.

6. Under ‘Letter Name’ type the name of the letter you’re going to include (e.g. “IRS Note”).

7. Type the text of your letter in the big white box (e.g. “No goods or services…”).

8. Click ‘Save’.

Back on the statement screen you will choose the letter in the drop down list back in step 4.

The new letter name will show up next to ‘Letter To Use’ in your Donation Statements window; it will now be included at the bottom of each statement. For future statements, all you’ll have to do to include the letter is click that same ‘Lookup’ button and select the letter’s name from the ‘Current Letters’ drop down.

For more information about donation letters or any of the other functions in the window for donation statements, go to Donations: Statements and click on ‘?help!’ in the upper left. A support forum post will come up with more detailed information. Please keep these ‘?help!’ options in mind when you have questions about other windows in IconCMO.

what is the IRS deadline date for providing statements to donors for charitable contributions?

Here’s the information I found in the IRS Publication on Charitable Contributions. You can review this document at https://www.irs.gov/pub/irs-pdf/p1771.pdf

“Recipient organizations typically send written acknowledgments to donors no later than January 31 of the year following the donation.”

Does the IRS accept the e-mailed statements as sufficient when filing taxes or should end of year statements be printed?

Pat, the email statements will work just fine as long as you include that disclosure on them!

Thanks for the info. However, why do you guys have to make it so complicated? Just put the statement on yourself and make it a part of the contribution statement! Or make it a button you click so you can choose to have it on there or not?

Sorry to hear that! Unfortunately, I’m not sure we could make it much simpler as there isn’t just one way to phrase that statement. The good news is that you do only have to type the IRS disclosure into the system once and then you can re-use it from year to year. So now that you’ve figured it out you should be good to go!